The FuturePrint Vision Report 2024 ‘Navigating Volatility’: Key Themes

Earlier this month we released the FuturePrint Vision Survey and Report for 2024. You can get your copy of the report here. We thought it would be helpful to share our narrative and highlight the key themes.

If 2023 has been defined by uncertainty - then what will be the defining characteristics of 2024? We think the title ‘Navigating Volatility’ illustrates both a positive forward motion while being realistic in that conditions remain unpredictable and volatile. In researching this survey and report - to gain a balanced understanding of the global economic outlook (by scouring analysis and predictions through all of the world media, economists and academics), there is little upbeat narrative to describe the likely performance of the world economy in 2024. Most analysts and pundits seem to agree that inflation will start to subside in 2024 which may have a marginal effect on consumer spending, but the uncertainty that has defined 2023, looks like it is set to continue.

The relative calm that defined the COVID period is in stark contrast to current stormy conditions. While we may all pine for a more stable and predictable 2024, many of the respondents to this survey seem to have accepted that volatility and disruption are now a normal backdrop of our business world. In their responses, these people display a robust outlook stating they are adapting and innovating, adjusting their expectations, and increasing their efficiency. This determination to take back control will likely enable these businesses to position themselves well for the future, with many respondents having expectations that things may begin to return to normal by the middle of 2024. A more resilient energy is empowering these respondents in the meantime to best position themselves for the inevitable upswing. These kinds of stories were in plentiful supply at FuturePrint TECH underlining that for those with an adaptable mindset, and a commitment to innovation, there is no reason to not have an optimistic vision for the future.

In contrast, for survey respondents who represent larger, more conservative corporate print technology/OEM businesses, this disruption seems to have impacted confidence. This has resulted in constricting decision-making and decreasing investment in R&D, technology and marketing. This more cautious approach may hold them back as soon as the economy begins to look brighter. As is the case, with austerity and consolidation, catching up to other more positive businesses when times become more certain will then pose a different kind of challenge. These businesses may not be equipped with the right leadership, people or culture. Our ageing industry needs youth and speed as well as experience and track record.

Across the industry, there remains a continued skills shortage that is only set to worsen. This places technology that automates and digitises processes, previously undertaken manually, into sharp focus. It is now a necessity, not just an interesting possibility. Over time, due to a confluence of skills shortages and changing demand, we expect Drupa to become more about the digitalisation of processes and software as opposed to heavy metal hardware sales. For commercial print in particular, extra capacity, when capacity is contracting, does not make sense in the long run, even if the investment is in digital printing technology. Skills shortage is a big deal - while volatility is what defines markets, confidence and politics, employment remains relatively high. 50 somethings have left the workforce, and there are simply not enough people to do the work. Solutions to this problem are critical for a healthy industry in the future.

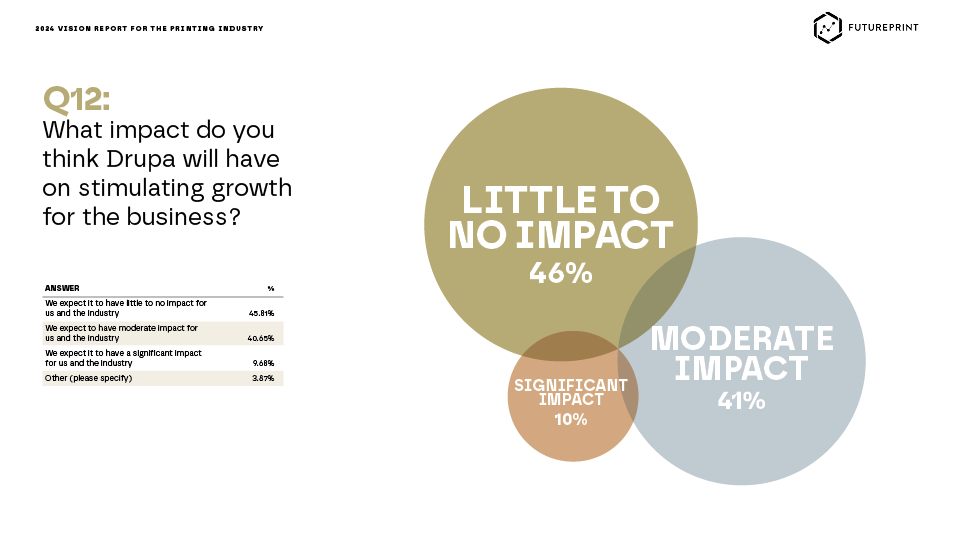

From the results of this survey, there is no doubt that many OEMs in the printing industry are expecting the ‘Drupa factor’ to have a significant impact on industry growth and their economic well-being. This, we believe, is a kind of fallback into a pre-COVID comfort zone that served the industry well for decades. Large booths, large investment and a large amount of hope that it will pay off. However, the world is a different place when compared to 2016. Buying behaviour has changed, economic challenges are more acute, and budgets are not what they once were. More B2B buying research is done online, a younger buyer profile, and a buying pattern that is closer to B2C. It's more buyer-led compared with the more traditional sales-led model of yesteryear.

When the hype on the show floor subsides, many OEMs may find themselves disappointed with their resulting ROI. For the majority of the PSP community who are feeling the brunt of the economic pressure, they are simply unlikely to feel any impact of a rebound due to OEM machine sales at Drupa, and even more so if they are located outside of the DACH region. Printers with distressed budgets and an anxious outlook on investment could well result in machinery sales falling below expectations. In short, it is unlikely Drupa will ‘fix’ the print industry in our view. How can it? This is not a critical remark about a trade show in decline, but rather an industry’s over-inflated expectations of the impact it could have. Drupa alone cannot lift an industry out of a downturn, no matter how much noise and marketing euros it may consume!

It is also important to note that visitors who attend trade shows are inevitably ‘in market’ as opposed to ‘out market’ in that they have a clear buying demand. See here for 95-5 rule. This tends to be 5% of any given B2B market in the good times, and even less in the tough. What are manufacturers doing in 2024 to reach the rest of the market?

While the impact on product sales for exhibitors at Drupa remains to be seen, the effect in terms of optimism and education could well prove to be motivating. 2024 will certainly be a year to refocus and reconstruct, and it might require agile product development to create fast solutions to new problems, and opportunities that present themselves due to this fast-moving change. This will require dynamic thinking, adaptive leadership & a culture that permits failing fast.

While the ‘column inches’ in 2024 will no doubt be dominated by large machine releases, there is a significant amount of ‘nano’ innovation that may get missed. In future, the print industry will be less about hardware, and more about software. This technology could enable automation, increase efficiency, improve sustainability, and enable predictive and generative AI and machine learning for print and manufacturing. Indeed, there will surely be a time when there will be no need for specialist print operators. In addition, innovations in ink chemistry, inkjet head technology, materials and data path are enabling inkjet printing for industrial applications, and in doing so opening up new markets to the possibility of digital inkjet and single pass. This kind of innovation may be difficult to see in the maelstrom generated by such a large event as Drupa.

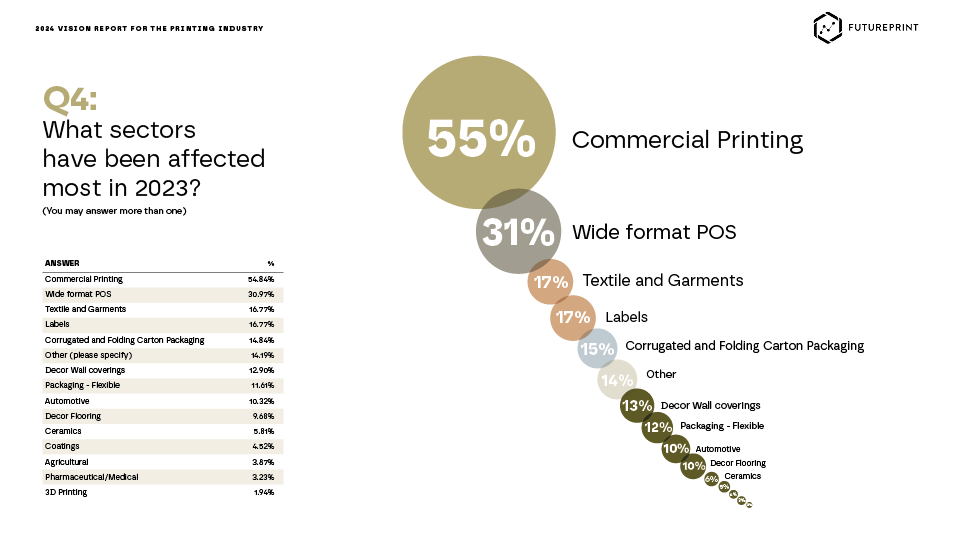

While commercial printing is reckoned to have suffered most from economic conditions, results from this survey reveal other sectors of the print sector showing greater resilience and growth opportunities. Packaging and labels continue to be the single most important sector that is expected to yield the greatest opportunity for new technologies such as digital printing. Labels, Folding cartons and Flexible packaging are showing a robust performance, overall corrugated production may be down when compared to the windfall during COVID due to the huge growth in online retail, but the inkjet community is innovating fast to provide digital technology solutions that give agility and flexibility to production for corrugated converters.

While technology can be developed to fill the gap once filled by people, the print sector, like many others, needs a brain gain. A big exit of talent and experience is not easily replaceable. Industry-wide a recruitment drive for younger talent must ensue to generate the next generation of leaders.

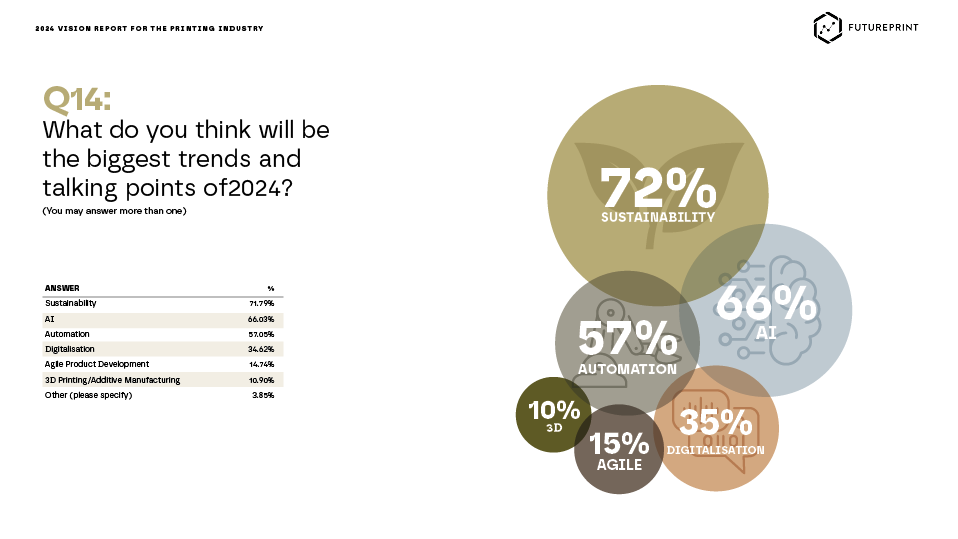

Given that the tone of the responses points to reduced sales, skills shortages and general volatility, and these factors continuing into 2024, it is somewhat surprising that the lead issue for the year is sustainability. Experience has shown us that the printing industry is a slow adopter of sustainable best practices, and while we agree that improved environmental performance should be the lead issue, often in a downturn the environment is secondary to economic concerns. We therefore remain cautiously sceptical that this will prevail given all of the other issues that are either less complex, with less need for strategic investment or have a shorter, easier-to-justify, ROI.

That said, the shift to sustainability must truly reach the print industry at some point, this is inevitable. COP28 has addressed the ‘Elephant in the Room’ in that Scope 3 has to be dealt with. The print industry is a sector that serves other businesses, so it is in the eye of the storm when the demand for transparent evidence of sustainable best practices becomes a non-negotiable buying requisite from consumer brands at the top of the chain. Those unable to provide this evidence will be placing their business in danger of falling foul of a fundamental change in buying, and will no doubt risk losing business as a result.

Not far behind sustainability, AI has risen to the top of the agenda. Seemingly from nowhere, OpenAI launched ChatGPT and the world became instantly aware of the potential and the power of this technology to be able to help and enhance process efficiency. Quite what this means for society, economy and global business remains to be seen but given the continual pressing issue of skill shortage and the fact that industry 4.0, automation and digitalisation are an accepted trend worthy of strategic long-term investment, then AI surely has a huge potential value to the future.

10 Key Themes from Vision Survey & Report

Continued Uncertainty and Volatility

Confidence Crisis: Some lead and move ahead boldly, others retreat from leading into a culture of austerity and past success

Drupa - Big Expectations from OEMS that the show will reignite the market, but will machine sales meet these inflated expectations?

B2B buying behaviour changes mirroring B2C impacting how printing technology is sold

Commercial & Wide format Print Down but Other Print Sectors show Resilience & Opportunity

Skills Shortage problem started by COVID continues regardless of economic turmoil & ageing industry

Technology’s Role is therefore Vital, not just interesting - and not just print tech - Software, Automation and AI are pivotal

Innovation - the power deemed crucial to galvanise, protect and futureproof

AI - The industry must get a grip on the opportunity this can provide

Sustainability - seems high on the agenda which seems in conflict with the tough economic climate - that said, COP 28 ‘Scope 3 is the Elephant in the Room’ - Is print finally listening?